From 11th to 14th November 2025, our firm, Messrs. Malcolm Fernandez, had the privilege of hosting a comprehensive Marine Insurance Training Programme conducted by Maritime S.p.A Services—right here at our office. Designed for legal practitioners navigating the complexities of maritime and insurance law, the four-day in-house training deepened our understanding of marine policies, risk assessment, port operations, and claim resolution.

The sessions were rigorous, hands-on, and directly relevant to our growing maritime litigation and advisory portfolio.

1. Overview of Marine Insurance Framework

The training began with an in-depth overview of the fundamental principles of marine insurance, including indemnity, utmost good faith, proximate cause, insurable interest, subrogation, and contribution—all of which underpin policy interpretation and claims resolution in marine insurance litigation.

Particular focus was placed on the nature of marine adventure, and the classification of perils covered under Institute Cargo Clauses A, B, and C. These principles were further contextualized with illustrations from both cargo and hull insurance perspectives.

2. Cargo Insurance: Coverage, Claims & Clauses

A key component of the training was the breakdown of cargo insurance policies, including:

Coverage under Institute Cargo Clauses (A, B, C)

Warehouse-to-warehouse coverage and voyage-specific limitations

Perils insured vs. exclusions: including piracy, fire, jettison, but excluding inherent vice, delay, and insufficient packing

The concept of General Average and Salvage Rights

The structure and impact of the Policy Disclosure Sheet

Participants were also guided through real-world claim scenarios and claim filing procedures—skills directly applicable to our shipping litigation and advisory practice.

3. Hull & Machinery (H&M) and Protection & Indemnity (P&I)

The sessions on Hull & Machinery Insurance (H&M) provided valuable insight into shipowner liabilities and ship-specific coverage. Topics included:

Agreed value vs. reinstatement

Types of losses (total, constructive, partial)

Collision liability (¾ liability rule)

Charterers’, shipbuilders’, and shipbreakers’ insurable interests

Complementing this was the exploration of P&I (Protection & Indemnity) coverage, which deals with third-party liabilities, crew and passenger injury claims, pollution liabilities, wreck removal, and stowaway issues.

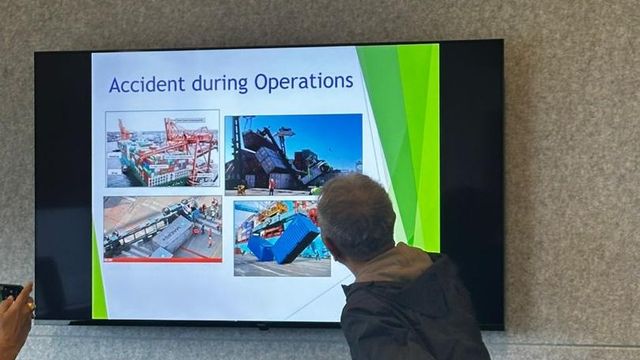

4. Port & Terminal Operations and Claims Investigation

The second day (12 November 2025) focused on Port & Terminal Operations (PTO), shedding light on:

Cargo handling procedures

Stevedoring risks

Equipment failures and operational liability

Role of surveyors and loss adjusters during claim investigations

The final two days (13–14 November 2025) were dedicated to underwriting, risk evaluation, and claims investigation techniques, with detailed analysis on:

Documentation required for filing and assessing claims

Types of damages and losses under marine policies

Procedural timelines, prescription periods, and reporting obligations

Best practices in avoiding common pitfalls in marine insurance claims.

5. Why In-House Maritime Training Matters

Hosting this programme in our office allowed for tailored engagement with our internal teams—litigators, transactional lawyers, and junior associates alike. The insights gained have already enhanced our capacity to advise:

Cargo owners, freight forwarders, and insurers on coverage and disputes

Shipowners, charterers, and maritime operators on H&M and P&I issues

Clients involved in port terminal liability, cargo damage, or enforcement actions against carriers

With Malaysia’s role in global shipping steadily growing, in-house upskilling ensures our firm stays ahead of maritime legal developments.

Conclusion

This intensive in-office training has further cemented Messrs. Malcolm Fernandez as a forward-thinking legal practice equipped to handle complex marine insurance, shipping, cargo, and port-related matters. We extend our sincere thanks to R. Uday Kumar and the Maritime S.p.A Services team for delivering a high-impact, highly practical training experience tailored to our needs.

As we expand our shipping and insurance litigation portfolio, this training has laid a strong foundation for deeper sectoral expertise—and ultimately, better outcomes for our clients.

This article is prepared by Vhimall Murugesan